Blogs

“Third-Party Posts”

Interest in Annuities Is Soaring: Understanding the 2025 Trend

Learn how the market, economy, and demographics are shaping the annuity industry. The annuity industry is having a moment. After years of mixed opinions and confusion...

Annuity Awareness Month 2025: Your Guide to Income Security

Each June, Annuity Awareness Month shines a spotlight on one of retirement’s most misunderstood—but potentially powerful—financial tools: the annuity. In 2025, as...

6 Ways to Secure Your Finances After Retirement

Although your CalPERS service retirement is a lifetime benefit, and you have other income sources available to you, money can still be tight. Making ends meet is a big...

Retirement planning with annuities in 2025: Key considerations and trends

Annuities have seen a resurgence in popularity as a retirement planning tool, especially in 2025, driven by market volatility, higher interest rates, and an aging...

7 steps to prepare for your upcoming retirement

Planning to retire within the next 10 years? Taking these actions now could help bolster your portfolio as you approach your planned retirement date. After decades of...

Getting Ready for Retirement Checklist

If the word “retire” is becoming your new mantra, we suggest you make a retirement checklist before you receive your last paycheck. It’s never too early (or too late)...

The Most Important Ages of Retirement

Retirement is a series of milestones that arrive as you age. Here are the ones you should know about. The retirement clock doesn't start the day you stop working. It's...

Social Security Benefits Changes in 2025: What You Need to Know for Smarter Retirement and Tax Planning

Social Security is one of the most essential yet misunderstood pieces of the American retirement puzzle. With all the recent headlines, ranging from benefit increases...

Planning to retire in 2025? Do these 7 things now

A wonderful retirement is the goal of many people, and you want it to come off without any major snags. But retirement plans always face challenges, whether it’s the...

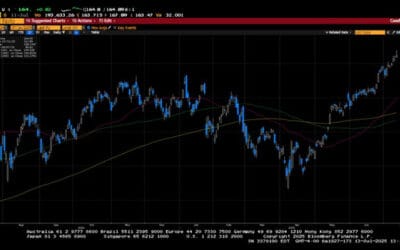

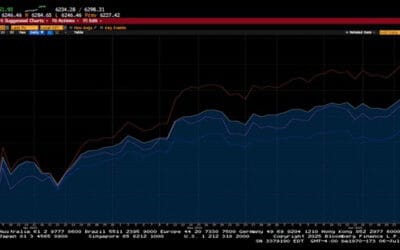

Weekly Market Commentary

Global financial markets had another positive week as the Dow Jones Industrial Average finally joined the S&P 500 and the NASDAQ with a new all-time high. Benign...

Weekly Market Commentary

Global financial markets rallied last week as investors stepped in again to buy the prior week’s dip in prices. Japan, Germany, Spain, and Italy were international...

Weekly Market Commentary

Markets forged another set of all-time highs before taking a step back last week as a deluge of information had to be digested by investors. August 1st was the tariff...

Weekly Market Commentary

The S&P 500 and NASDAQ reached another set of all-time highs, driven by constructive rhetoric on global trade and positive second-quarter earnings results from...

Weekly Market Commentary

U.S. equity markets were little changed for the week; that said, the S&P 500 and NASDAQ were able to forge another set of all-time highs. A busy Q2 earnings...

Weekly Market Commentary

A barrage of tariff letters sent to over 20 countries by President Trump yielded very little movement in the financial markets. Trump announced that there would not be...

Weekly Market Commentary

The holiday-shortened week produced another week of gains for US equity indices. The S&P 500 was up 10.6 % in the 2nd quarter, while the NASDAQ composite rose...

Weekly Market Commentary

The S&P 500 and the NASDAQ joined the NASDAQ 100 in forging new all-time highs in an extremely busy week for Wall Street. A de-escalation of the Iran-Israel-US...

Weekly Market Commentary

Despite there being plenty for investors to consider, the holiday-shortened week ended pretty much where it started. Israel and Iran continued to exchange missile...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Glad Cleveland) or (Cleveland Financial Solutions) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Cleveland Financial Solutions.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Best of the 2025 Slott Report

By Sarah Brenner, JD Director of Retirement Education ‘Tis the season for lists! Best TV shows, best of music and best podcasts. The lists go on and on. In the spirit...

Grinch Gifts: Penalties and Missed Opportunities

By Andy Ives, CFP®, AIF® IRA Analyst The Grinch likes it when things go horribly wrong. He likes it when rambunctious pets tip over Christmas trees. He likes it...

Holiday Cheers and Jeers

By Ian Berger, JD IRA Analyst In the spirit of the holiday season, here’s a list of cheers and jeers for the IRS and Congress: Cheers to the IRS: To its credit,...

5 Exceptions to the Year End 2025 RMD Deadline

By Sarah Brenner, JD Director of Retirement Education The holidays are here and the countdown to year’s end has started. For many retirement account owners, this means...

Qualified Charitable Distributions and Inherited IRAs: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: If a grandchild, age 30, inherits IRA assets from her grandparent, age 92, and has to take...

The Wonderful, Magical Form 5498

By Andy Ives, CFP®, AIF® IRA Analyst In a scene from “The Simpsons,” daughter Lisa announces she has become a vegetarian. Homer asks some probing questions. “Are...

IRS Addresses Unanswered Questions About Trump Accounts

Ian Berger, JD IRA Analyst As is often the case with new legislation, the One Big Beautiful Bill Act (OBBBA) left unanswered a number of questions about Trump...

First-Time Required Minimum Distributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: My client turns age 73 in November 2026. If he takes his first required minimum distribution (RMD) in December...

New IRS Guidance on Trump Accounts Is Released

Sarah Brenner, JD Director of Retirement Education The IRS has issued guidance on Trump Accounts, which are new tax advantaged accounts for children established...

Seven Medicare Changes Coming in 2026

Learn about the benefits that become permanent features of Medicare in 2026 and other changes as they are released. Knowing how Medicare is evolving and which benefits you can rely on will help you focus on whether Original Medicare or a particular Medicare Advantage...

Navigating Medicare Changes in 2025 for People Living with ALS: A Comprehensive Guide

Living with ALS presents a unique set of challenges, especially when it comes to managing your health care needs and medications. In 2025, important changes are coming to Medicare that could significantly impact how you access prescription drugs and manage your...

Colorectal cancer screenings can save your life

Get a colorectal cancer screening at no extra cost to you. Learn more about life-saving screening options. Have you been putting off your colorectal cancer screening? It may not be the top of your to-do list, but regular screening tests can save lives. Colorectal...

Get the care you need quickly when you’re sick

Discover six ways to access care fast, even if your doctor is busy. Hint: You may not need to go in person. Doctors’ offices are busier than ever these days. Sometimes it can be tough to book a timely appointment with your primary care provider. You might be sick or...

Can You Apply for Medicare Without Social Security?

Key Points You do not need to be receiving Social Security benefits to apply for Medicare. You can receive Social Security benefits as early as 62 and Medicare benefits at 65. If you are already receiving Social Security benefits before your 65th birthday, you’ll be...

Is the Medicare Annual Wellness Visit Mandatory?

Key Points While the Medicare Annual Wellness Visit is not mandatory, it is a 100% covered preventive service. The Annual Wellness Visit differs from the typical annual physicals you were used to with group coverage. If you’ve had Medicare Part B for more than 12...

Why You Need Part D

Key Points Medicare Part D is a voluntary program, but if you do not enroll in a plan, you won’t have coverage for expensive medications. You will also have a late enrollment penalty if you don’t have other creditable coverage. Medicare Part D is a huge time...

Medigaps

Original Medicare Part B covers 80% of the cost of most services. But what about the other 20%? Or the other out-of-pocket costs like deductibles or inpatient copays? Let’s discuss Medigaps, which can help cover these costs. What are Medigaps? Medigaps are health...

Medicare’s 2025 Surprise: Higher Costs, New Caps, and Vanishing Perks

Big changes are coming to Medicare and Social Security in 2025, and if you’re on Medicare—or soon will be—you need to know how these updates could impact your costs and coverage. Financial Sense’s Jim Puplava recently spoke with Medicare expert Brian McArthur to get...